Thursday 22nd of August 2024

It is never too easy to evaluate a small service business for sale whether you are the owner or t

...he potential buyer. While the seller aims at infla...

It is never too easy to evaluate a small service business for sale whether you are the owner or the potential buyer. While the seller aims at inflating the price, the buyer tries to focus his attention on the future of the venture to kick-start the negotiations. There are a lot of factors which affect the final price that can be pitched to the buyers. The owner must take into account the earnings, profits, debts, loans, assets, industry trends, etc. while determining the cost.

The buyer must also be aware of all these inclusions and conduct due diligence of the business without getting influenced by the claims of the owner and the broker. If you are looking for a small business for sale in Australia, you must understand the different ways of its valuation. It helps in the assessment of the profitability and the future potential of the business and can help you in making an informed decision.

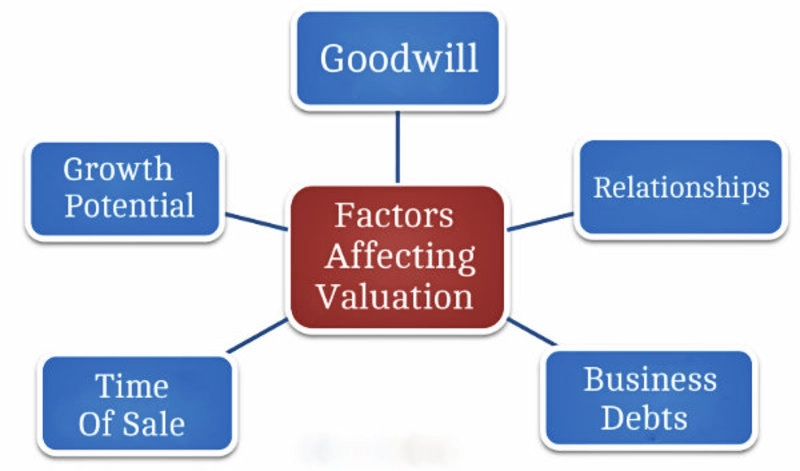

Factors That Can Affect The Pricing

There are some critical but immeasurable factors which can affect the pricing such as goodwill, intellectual property, growth potential, and relationships shared with suppliers, clients and vendors. Thus the valuation must include both the tangible and intangible assets. Another factor that can affect the prices is the time of the sale. If the market is down and the trending rates are at an all-time low, you can expect a lower price for your business.

Also, circumstances like a forced sale due to retirement or health concerns can make the owner accept an offer without much negotiation which can fetch a lower value. Lastly, the years of establishment too can affect the final quote. For instance, a long established business with a significant market share and customer base will be sold off at a higher price than a new venture still struggling to find its place in the trade sector.

So keep these points in mind while working on the valuation of a business. You must also understand the fact that there is no single formula for assigning a value to the business. You can utilise a combination of methods to assign a desired value to the entity. Let us take a look at the five most common ways of calculating the worth of a small service business.

Industry Trends For Setting The Price

Before embarking on the journey of the sales process, you must acquaint yourself with the legal steps of selling a business to get things in order and adhere to the state laws. Many industries have their own rules to evaluate a business depending on the nature of the organisation. For example, sometimes the price is dependent on the turnover of the venture and at other times on the number of customers acquired and ongoing long-term contracts.

It is quite possible that a company may have long-term contracts but is making very little profits. In such situations, the buyer is the best judge and needs to know what he wants to earn from the purchase. You need to research the industry to stay updated with the rules of business valuation and conduct thorough market research to collect all the required data.

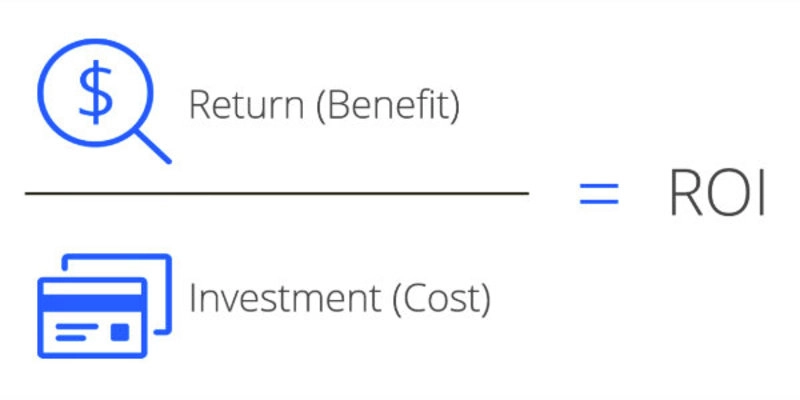

Return On Investment Method For Valuation

It is the most popular system which uses the net profit of the business to assign a value. The formula used in this technique is: ROI = (Net Annual Profit/Selling Price) x 100. Thus as a buyer, if you want to find out the ROI of a company, you can use this formula. If you are a seller who wants to find out the cost of his organisation, then you can tweak the formula like this: Selling Price = (Net Annual Profit/ROI) x 100 and get the price.

The Asset Valuation Method

To calculate the worth of a business, you can add up the assets (both tangible and intangible) and subtract the liabilities. For example, if a business owns equipment and stock worth $350,000 and the debts are close to $50,000, then the selling price will be $300,000. As a buyer, you can opt to purchase the assets of the business while the debts can be covered by the seller. However, calculating the assets can be a tedious task as you need to figure out the assets listed in the books and determine the net book value while taking the depreciation of the assets into account.

For this, you will need the help of a professional accountant who can calculate the value of goodwill and find out the depreciation of assets. Depreciation is nothing but the loss in the value of the assets with each passing year. For example, if you purchased an industry-grade machine for your organisation for $2500 two years back. It will not hold the same value at present. Your accountant will be able to help you in this regard.

Entry Cost Valuation Method

According to this methodology, you will have to calculate the cost of starting the same business from scratch in the current scenario to find out its present worth. The entry cost must include the expenditure of buying equipment, stock and tools, getting all the permits and licenses, hiring and training of staff members, product development, marketing and advertising costs, property lease, digital marketing, etc. So you can make a comparison of the total cost and then decide on the fair value of the entity.

Future Profit Valuation Method

The future projections of the business are equally critical for the buyer and the seller. The buyer will base his decision on the viability of the venture in the coming years and the seller can ask for a higher price if he can showcase a profitable bottom line in the future. The future profits can be calculated with the help of an accountant by taking into consideration the financial information of the business for the past 3 to 5 years. You can also include conditions like competition and future market conditions to predict the value.

Conclusion

The ways mentioned above can help you move forward in your quest for finding a business for sale in Australia. However, you must consult industry experts, brokers and an accountant to find out the correct valuation of a business before taking the plunge.

Selling a business built over years of dedication, blood and sweat is among the most difficult decisions to make. The process of finding a qualified...

Acquiring an established, promising and high growth retail store in Australia is one of the best ways to capitalise on your investment. The Australian...